|

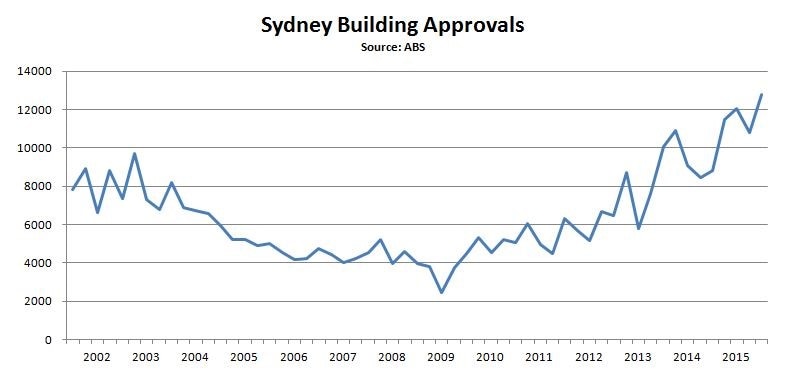

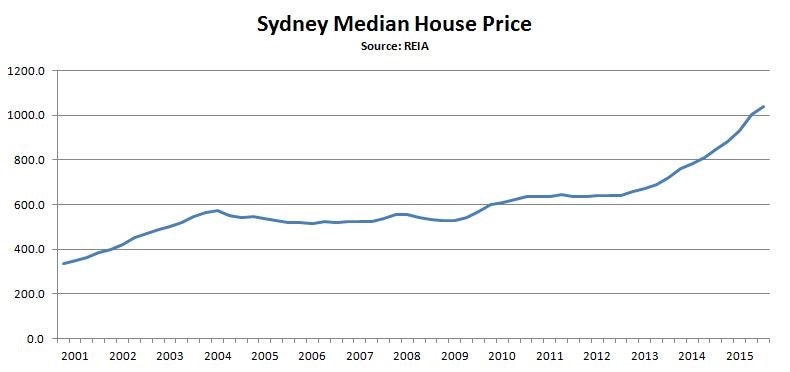

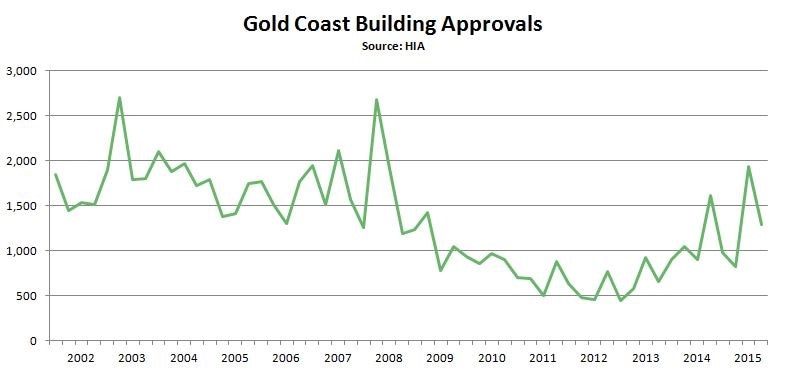

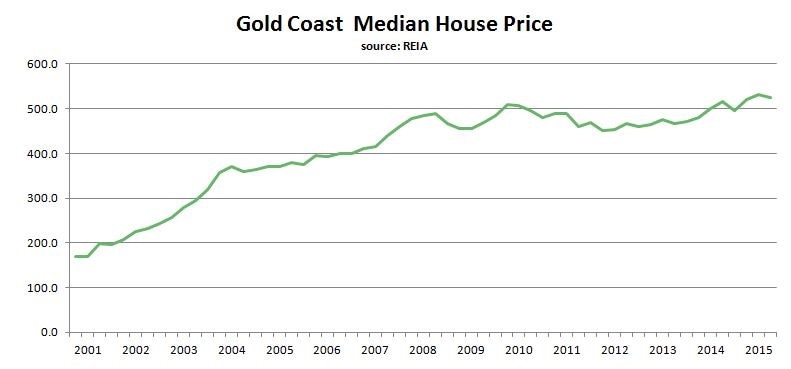

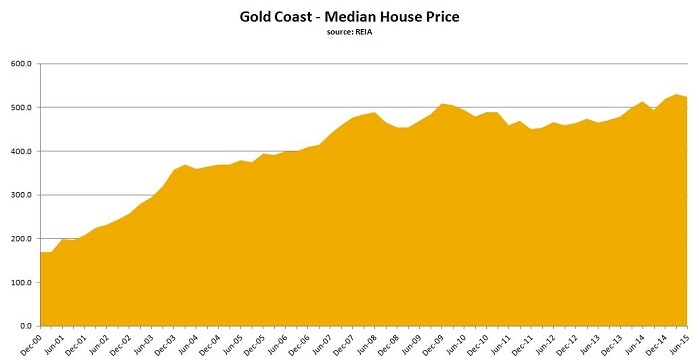

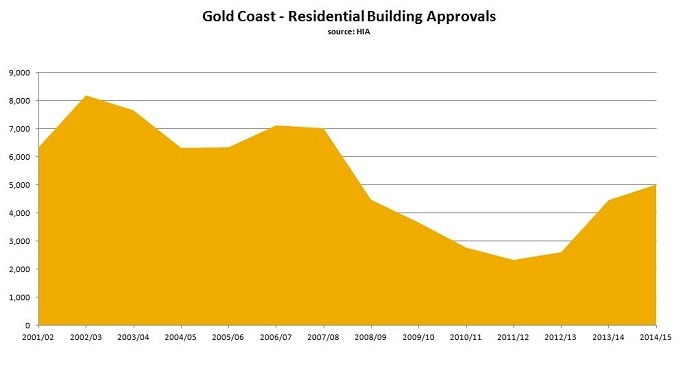

I hope you’ve had a great start to the new year. Now that things are beginning to normalize as everyone gets back to work we thought it timely to send out a quick update. You may recall we sent you a message just before Christmas about new property recommendations in south east Queensland, today I’d like to follow up with some explanation as to why our market recommendations have shifted in recent times. Predicting the future course of any property market is more a function of supply and demand than anything else. The “Sydney” charts below illustrate a real and recent example of how prolonged periods of low construction can be (and generally are) followed by rising property values. An extended period of low construction (combined with an increasing population) will eventually leave a market in a state of undersupply. The further a market falls into undersupply, the more upward pressure is applied to property prices, the result of which is a period of rising values as we’ve seen play out in Sydney over the last few years. On the back of around 60% growth in values since 2012, construction in Sydney has now reached historically high levels. This will eventually lead to a period of stagnation, or even a slight decline, in values as supply outpaces demand. Queensland’s Gold Coast is currently presenting as fundamentally stronger than any major market in the country. Having experienced a number of years of low construction levels and sluggish growth this market is now in a strikingly similar position to Sydney back in 2011/12. Consequently, we believe well researched property in the Gold Coast region at middle price points currently represents some of the best property investment in Australia.

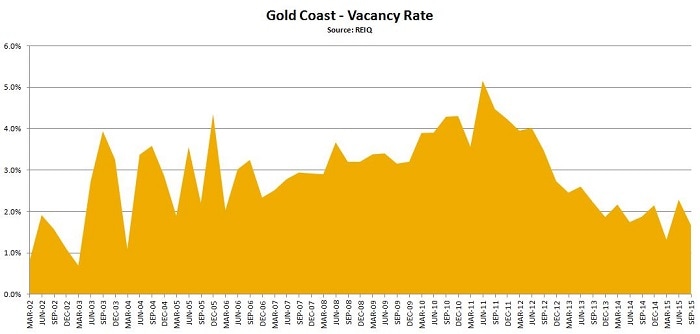

You may have noticed we’ve not been very vocal recently. Over the last few months we’ve been quietly working away on a plan for the period ahead. More on that in a moment… It’s no secret we’ve had a great run in Sydney (and more recently the Central Coast) over the past few years, the Sydney median house price has increased dramatically and all of us who recognised the opportunity should be well pleased with the results. Some recent highlights have included The Minchinbury Winery where RP Data valuations are showing increases of around 50% above purchase price. Durham Street Apartments which has finally come to fruition with pre-settlement bank valuations coming in over 30% above purchase prices. The Rise at Glenmore Park which settled around June and then in August three apartments sold for more than 20% above the original prices, not to mention Skye Apartments at Gosford where local agents are reporting sale prices more than 30% up on our stage 1 recommendation of last year. All in all, it’s been a productive couple of years. So what now?… With residential construction on the rise in Sydney, it’s inevitable that growth will begin to slow as the housing supply gap closes, we’re certainly not saying that this will happen overnight – it’s worth noting that the most recent REIA data release showed the highest quarterly growth in Sydney medians since June 1991 – but it will happen. It’s clearly time to be looking to other markets… As we mentioned back in April, we’ve been keeping a close eye on south east Queensland for a while now and after spending much of the last six months doing our homework, we now have a couple of new property investment recommendations in Brisbane and on the Gold Coast to share with you. The Gold coast is arguably in a better position than all other major cities at present. Building approvals fell away significantly in 2007 and have just started to climb again over the last couple of years. The lack of housing stock is evident in the low vacancy rate of 1.7% which has been trending down for the last five years and is now lower than all capital cities. Median house prices are only 7.1% above the peak of eight years ago, leaving significant room for future growth. While we believe the outlook for the Gold Coast is promising, it should be noted that this is a comparatively smaller market and, due largely to it’s lack of economic diversity, can be a tricky one to navigate. For the best result, property in this market should be carefully selected based on a clear understanding of local demographics. Brisbane, while not presenting as strongly as the Gold Coast, does offer a viable alternative for the more risk averse investor. Being a larger city (around four times the size) and supported by a wider range of industry, the Brisbane economy is less susceptible to outside variables and may provide a greater level of stability over the longer term.

It should be noted that construction activity has increased significantly in inner Brisbane recently and investors should be carefully targeting middle to outer areas in close proximity to transport and employment hubs. |

AuthorAn ongoing collection of thoughts, opinions, observations and recommendations by long time property analyst and commentator Brett Johnson. Archives

November 2017

|

The inside information on residential property investment