|

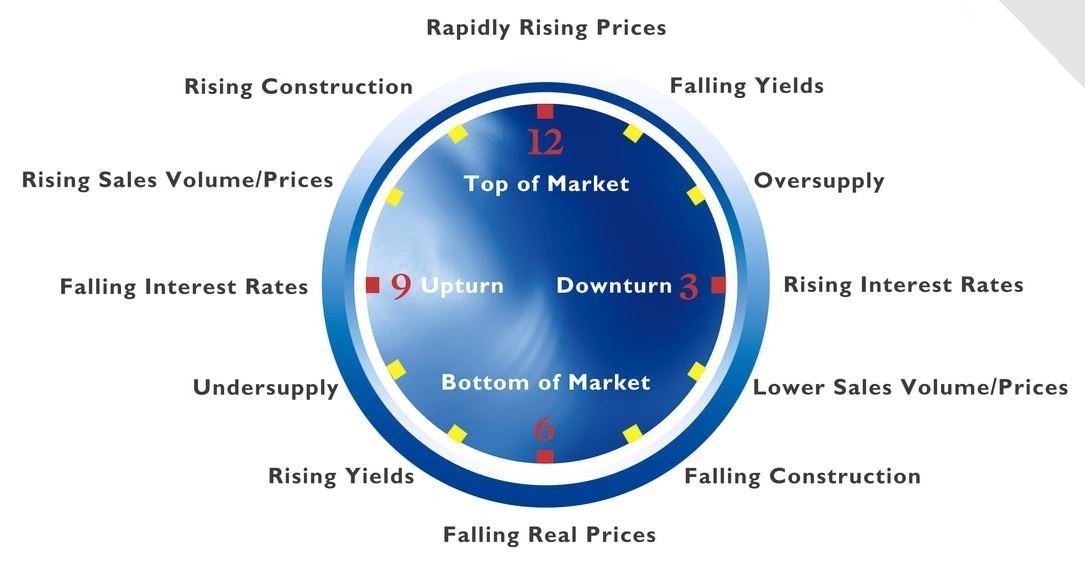

The Australian Residential Property Clock

Residential property markets follow a clear cycle through a sequence of distinct phases. During a period of strongly rising values the rate of construction of new dwellings increases. Developers and speculators are constantly monitoring the investment equation. With values rising strongly there is an enhanced potential return. More projects become viable and the rate of construction increases dramatically. It's during this phase that media headlines about house prices are most sensationalised and sales volumes are highest. As construction of new dwellings outpaces population growth and household formation, there will eventually be a surplus of property. |

Click image to enlarge.

|

Values will tend to stagnate and real values may fall. Vacancy rates in the rental market will rise.

Developers, and speculators withdraw from the market and the rate of new construction declines. Population and household formation continues to increase, progressively absorbing the excess construction. On the cycle goes, until demand exceeds supply. Vacancy rates fall and rents begin to rise. This is followed by increasing prices as we move towards the next cyclical peak. The Australian residential property clock was developed by Brett Johnson in the eighties. Most Australian cities have been around the clock three times since then.

© Copyright. The Real Estate Analyst |

The inside information on residential property investment