|

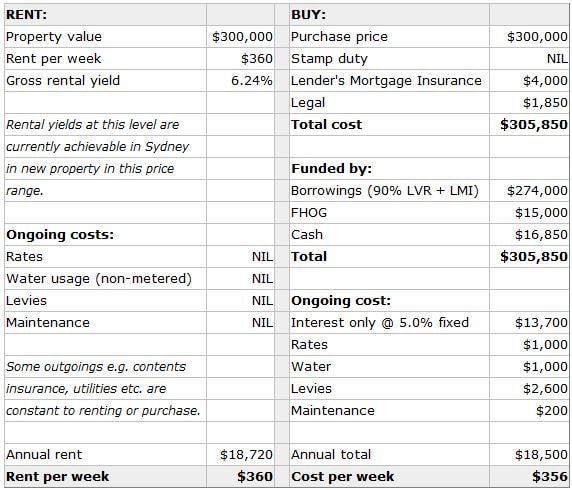

One of the triggers in the recovery stage of the residential market cycle is the point where it becomes attractive to tenants, based purely on the cost of living in an environment where rents have been rising and interest rates have been falling, to consider making the leap from renting into home ownership. When a market reaches this point, it usually follows that first home buyer demand picks up in overall volume, which in turn starts freeing up other market segments as non-first home buyers take the opportunity to upgrade their homes. A butterfly effect ensues and we see an increase in sales volumes flowing up the property food chain and into the broader market. Here’s the current comparison between buying and renting in the Sydney market that I mentioned a few weeks ago: The key to this example is buying new property (to qualify for grants and stamp duty exemption), having sufficient cash deposit and being able to demonstrate at least 5% genuine savings to satisfy a lender. This requirement may be met in some cases with evidence of meeting regular commitments in the past such as rent. It may also be possible to borrow a higher percentage and therefore require a smaller cash deposit. This would add to the ongoing cost. At 95% LVR the additional cost equates to $17 per week including a higher LMI premium.

A pedantic reader will point to the opportunity cost of foregone earnings on savings if used as a deposit for purchase. While technically correct I’d suggest that it carries little weight in the actual decision-making process and is negligible anyway. So there you have it. Keep an eye on the Sydney market and the progressive increase in numbers (albeit off a very low base) of first home buyers and their impact on prices over the months ahead. |

AuthorAn ongoing collection of thoughts, opinions, observations and recommendations by long time property analyst and commentator Brett Johnson. Archives

November 2017

|

The inside information on residential property investment