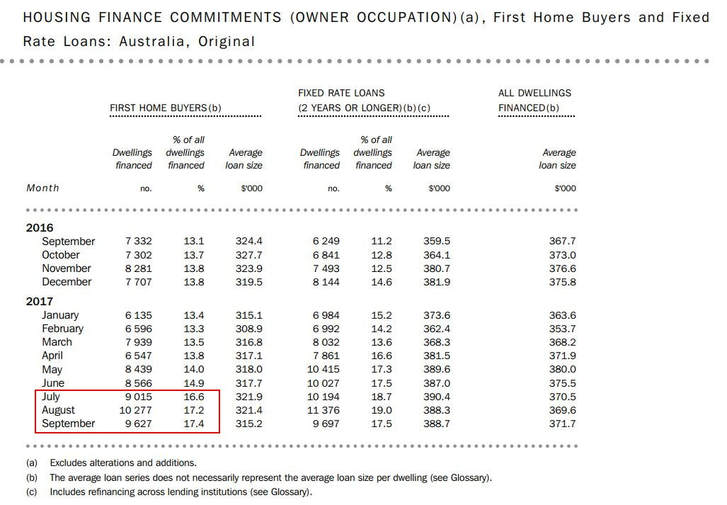

Late last year Australian demographer Bernard Salt famously and somewhat ironically mentioned in a satirical piece about baby boomers that smashed avocado on toast was the reason the hipster generation (meaning millennials) haven't found their way into home ownership. It went global even though he didn't really mean it. This misconception has been going on for a while. It's true millennials haven't been buying first homes in the same numbers as their forebears, but it's not because they've been brunching their home deposits away. First home buyers virtually fell off the Australian housing radar about 5 years ago. Some argue the increased cost of housing was the primary reason and it was all the baby boomers and their tricky tax break's fault. Not true. State governments' manipulation of housing grants and stamp duty exemptions (or the lack thereof) is demonstrably the strongest correlation with the disappearance of first home buyers (FHB's) in recent times. Essentially what happened was state governments reasoned that the affordability problems faced by FHB's were due to supply constraints. Not enough dwellings to go around. So they introduced incentives for FHB's to buy new property and removed incentives (like waiving stamp duty) for FHB's buying existing (older) properties. New properties in a given area are inevitably higher priced than existing properties (by more than a stamp duty saving) so all government did was raise the bar to a point that less than half the number of FHB's, compared to previous years, could do anything at all. Even though governments were right in a big picture, long term sense (it is a supply issue...but of their own making), they definitely created a classic case of throwing the baby out with the bath water. It didn't work. At least not for the target audience. Proving the point, they have now started reversing the process. The NSW government re-introduced stamp duty exemptions for FHB's buying existing properties in the last state budget with effect from 1 July this year. In recent months Queensland has seen the largest number of first home buyers in the market since October 2009. Across the entire country the number of FHB's as a proportion of all transactions has increased dramatically over the last few months. Gaze upon the following national data with wonder and amazement. There is a serious turning point happening before our eyes. So despite significant price growth in some markets, tougher lending conditions and no changes to tax breaks, it seems FHB's are staging a comeback. And good on them. Incentives to get on the home ownership/property ladder have been around for decades, not as a market manipulation device but as a tax-payer funded social incentive to get a leg up. I received a first home buyer grant when I bought my first home thirty something years ago. Why should it be any different now? Aren't we the miracle economy? The envy of the known universe?

The solution was never to poke millennials with a stick. Governments need to look at the costs associated with getting new property to market. They have been playing with stamp duty exemptions (among other things) as a lever to pull to solve a supply issue when one of the real issues is the stamp duty rate itself. Stamp duty bracket creep is obscene. Rates haven't been reviewed or changed since the eighties. I've written about this before so I'll spare you the tirade. Suffice to say blaming the next generation of market entrants for planning failures and playing them as fools is a mistake. It's not their fault. In over 35 years of being obsessed with the behaviour of property markets I am yet to see a successful example of government intervention that has lead to anything but tears, for government. But there is always a silver lining. It's early days, but it will be really interesting watching the impact of all that latent first home buyer demand entering the market over the period ahead. The avocado apocalypse may be upon us. Sure, they may talk about work life balance and having a positive impact on the world more than past generations (as if there's something wrong with that), but no prizes for guessing which section of the digital newspaper they've been reading over their avocado toast for the last five years. They're coming...be prepared. |

AuthorAn ongoing collection of thoughts, opinions, observations and recommendations by long time property analyst and commentator Brett Johnson. Archives

November 2017

|

The inside information on residential property investment