|

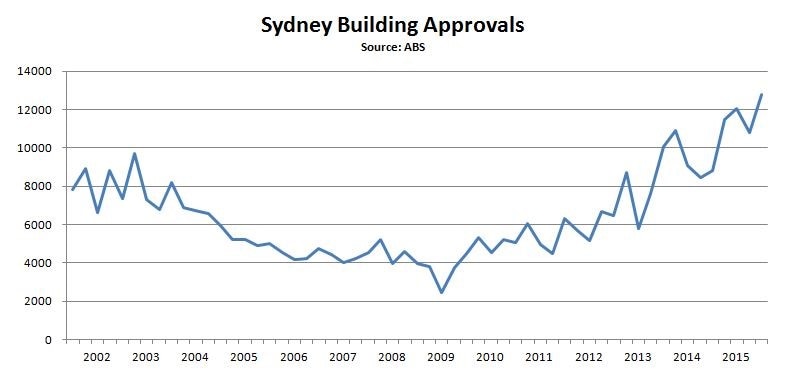

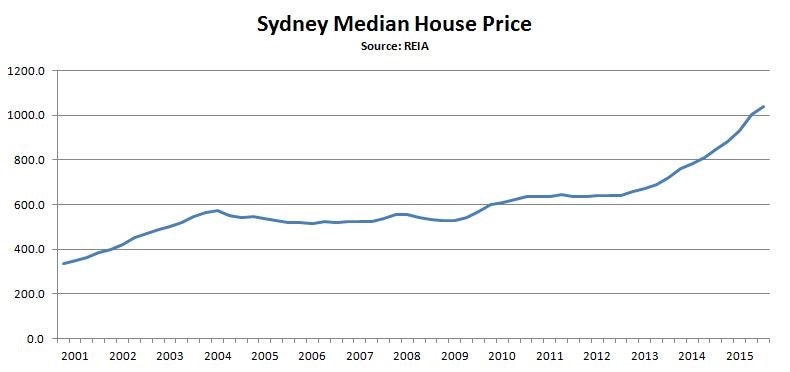

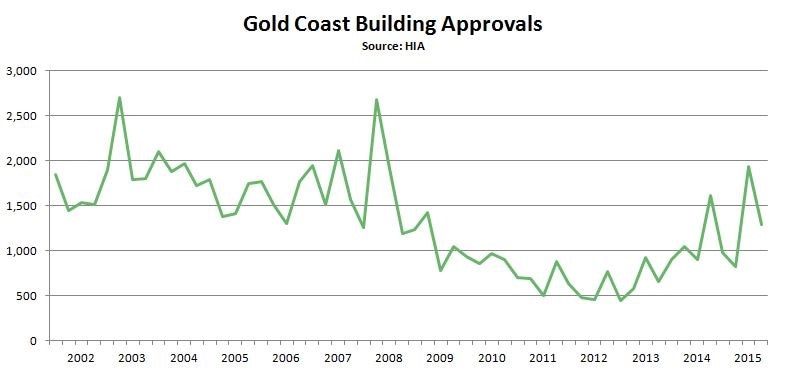

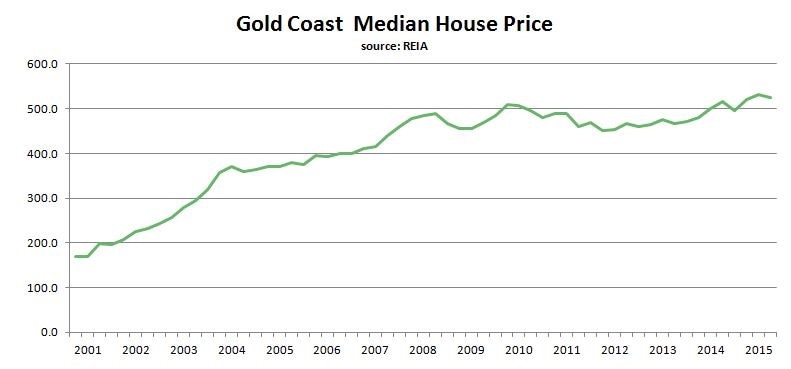

I hope you’ve had a great start to the new year. Now that things are beginning to normalize as everyone gets back to work we thought it timely to send out a quick update. You may recall we sent you a message just before Christmas about new property recommendations in south east Queensland, today I’d like to follow up with some explanation as to why our market recommendations have shifted in recent times. Predicting the future course of any property market is more a function of supply and demand than anything else. The “Sydney” charts below illustrate a real and recent example of how prolonged periods of low construction can be (and generally are) followed by rising property values. An extended period of low construction (combined with an increasing population) will eventually leave a market in a state of undersupply. The further a market falls into undersupply, the more upward pressure is applied to property prices, the result of which is a period of rising values as we’ve seen play out in Sydney over the last few years. On the back of around 60% growth in values since 2012, construction in Sydney has now reached historically high levels. This will eventually lead to a period of stagnation, or even a slight decline, in values as supply outpaces demand. Queensland’s Gold Coast is currently presenting as fundamentally stronger than any major market in the country. Having experienced a number of years of low construction levels and sluggish growth this market is now in a strikingly similar position to Sydney back in 2011/12. Consequently, we believe well researched property in the Gold Coast region at middle price points currently represents some of the best property investment in Australia.

|

AuthorAn ongoing collection of thoughts, opinions, observations and recommendations by long time property analyst and commentator Brett Johnson. Archives

November 2017

|

The inside information on residential property investment